Total number of patients in Ethiopia reached 130 as of 30 April 2020. The Ethiopian government took serious measures to control the pandemic. It closed land borders, schools and suggested most employees to work from home. Regional states suspended transportation services and imposed a ban on the movements of people. Prime minister has refrained from imposing the kinds of lockdown seen elsewhere in the region. If temporary lockdown should take place in the country, this will severely affect the economy by way of slowing down economic activities, such as merchandise trading, export and manufacturing.

As an import-dependent and supply constrained country, the pandemic will severely affect imports. Shipping lines will also be affected by travel bans and it will take more time for cargo transport. This may have its negative implications on palm oil imports into the country leading to a severe shortage of the commodity in the market as well as higher prices. This will also hit the service sector, including hotels, restaurants, and tourism. Noting that the service sector contributes over 45% of GDP, the impact of such reductions might affect the larger economy.

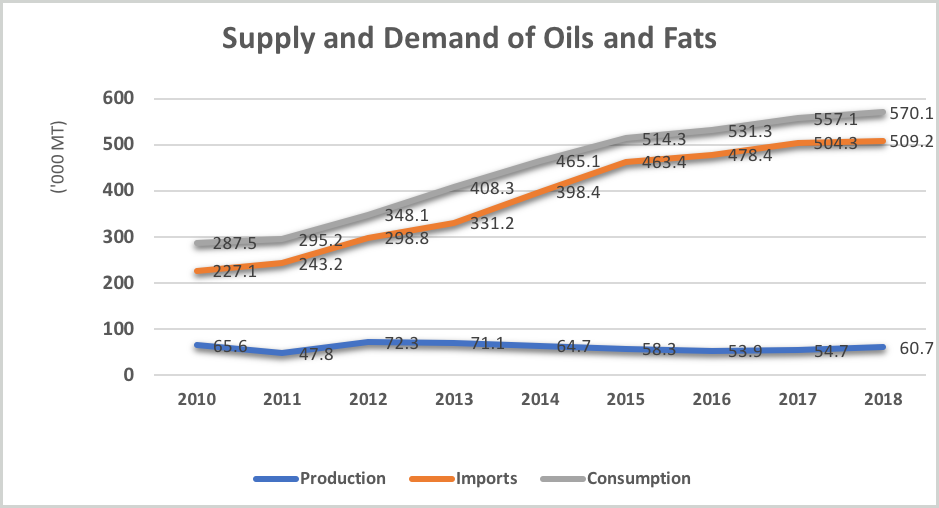

According to the GAIN report, total edible oil consumption in CY 2020 was estimated at 615,000 metric tons, of which 95 percent will be imported. Most of the oil consumed is mainly imported palm oil, followed by sunflower oil and locally produced Niger seed oil. Small amounts of soybean, linseed, groundnut, and cottonseed oils are also consumed. The Government of Ethiopia subsidizes edible oil imports and sets the selling price to make it more affordable to the consumers. The government distributes the imported oils to district unions for sale under mandated tariffs. The government in return supports the companies by giving duty-free privileges and foreign currency exchange.

| Oilseed Production (1000 T) / Oct-Sept | |||||

|---|---|---|---|---|---|

| Crop | 18/19 | 17/18 | 16/17 | 15/16 | 14/15 |

| Soybeans | 95 | 98 | 81 | 90 | 72 |

| Cottonseed | 85 | 80 | 65 | 75 | 85 |

| Groundnuts | 88 | 85 | 91 | 80 | 73 |

| Rapeseed | 55 | 50 | 43 | 61 | 54 |

| Sesame seed | 260 | 285 | 295 | 420 | 289 |

| Linseed | 94 | 90 | 88 | 98 | 83 |

| Castor seed | 9 | 8 | 10 | 11 | 11 |

| Total | 686 | 696 | 673 | 834 | 666 |

Source: Oil world

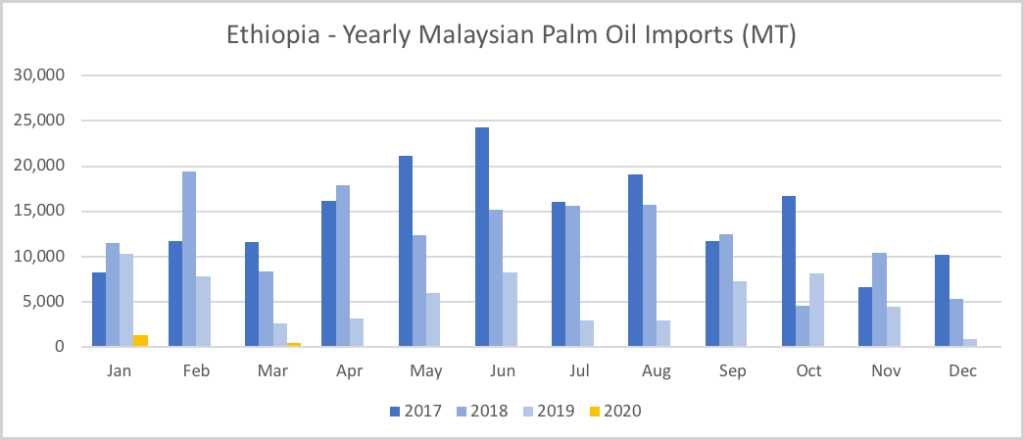

Ethiopia annual production capacity of oil seeds recorded at less than seven hundred thousand metric tons, with such insufficient quantity, demand can only be met through importation in the short-term. Starting from last quarter 2019, imports of palm oil significantly dropped more than 50% due to the shortage of foreign currency and the Ethiopian government only located limited amount of palm oil import. Currently, imports and distribution of palm oil are temporarily made by The Ethiopian Trading Businesses Corporation and the Ethiopian Industrial Inputs Development Enterprise. As informed by local industry players, the situation would improve in the second quarter this year.

Early 2020, the Ethiopian Government announced inauguration of a huge and modern edible oil processing plant in Ethiopia. This approach is mainly to save foreign currency expenditure on the imports of edible oils. The first stone was laid on Dec 28. The plant estimated capacity to produce around 500 metric tons of oil per day, enabling Ethiopia to save 25% of the expenditure it uses to import edible oil. Currently, the local production meets only 10% of demand. Horizon Plantations led the project. Local production would cover mostly the soft oil demand in the market as the factory would be processing groundnut, soybean, sunflower, and cottonseed.

| Palm Oil Imports by Country | |||||

|---|---|---|---|---|---|

| Country | 2014 | 2015 | 2016 | 2017 | 2018 |

| Indonesia | 309.7 | 299.2 | 200.2 | 137.6 | 123.2 |

| Malaysia | 75.8 | 125.1 | 227.7 | 296.3 | 306.9 |

| Saudi Arabia | 0 | 0 | 7.3 | – | – |

| UAE | 5.3 | 20.2 | 22.7 | 22.4 | 21.9 |

| Italy | 1.9 | 0.2 | 0.1 | – | – |

| Other Countries | 1.2 | 1 | 1.9 | 1.3 | – |

| Total | 394 | 445.6 | 460 | 457.6 | 454.0 |

Source: Oil World

Palm oil is the most affordable oil compared with other soft oils and highly demanded by local industry users and end consumers in Ethiopia, accounting for more than 80% of the total edible oil imports. Locally produced soft oils hardly competes with palm oil inexpensive price. Apart from local soft oil production’s enhancement over the past several years, government of Ethiopia encouraged local and foreign investors to take part in palm oil processing. Some international companies entered into some forms of agreement to either take part in supply tenders or setup of edible oil factories in Ethiopia.

Prepared by Mohd. Suhaili Hambali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.